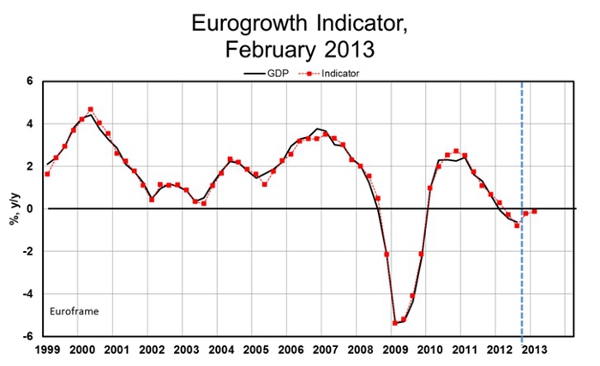

The Eurogrowth Indicator, calculated by the Euroframe group in the beginning of February, points to a frail recovery of Euro Area growth in the winter after a technical recession in last summer and autumn. In line with the January estimate, the February indicator predicts zero quarter-on-quarter GDP growth for the last year’s final quarter. However, the estimate for the first quarter of 2013 inched up by 0.1 percentage points indicating some firming of the recovery. Nevertheless, total output in the Euro Area would still remain 2.3 per cent below the last peak in the first quarter five years ago, although only 0.1 per cent lower than in the first quarter last year.

The slight rebound in the outlook from January stems from a small rise in the contribution of construction confidence. The real exchange rate of euro vis-à-vis the US dollar, which affects the indicator with a lag of two quarters, has contributed positively to the Euro Area GDP growth for five consecutive quarters already. The effect of the recent strengthening of the euro is not yet visible, but it will – if permanent – begin to reduce the contribution in coming quarters. The turnaround in stock prices in early summer 2012 with some set-back in the autumn has supported the indicator especially in the reviewed quarters. On the other hand, the contributions of industrial and household confidence still continue to depress growth predictions on the quarterly basis, although the recently improved monthly surveys point to change for the better.

The predicted end of the recession followed by a fragile recovery is very vulnerable to changes in economic agents’ expectations. Deepening political problems in the Euro Area crisis countries could mark a turn for the worse by depressing industrial and household as well as dent the rise in stock prices also in other countries. The encouraging stabilization of government bond markets since last August owes much to the announcement of the OMT programme by the ECB and the coincident progress in plans on banking inspection and resolution. Needless to say any setbacks in the implementation of these plans could easily change expectations for the worse and depress growth.

February 4, 2013

Paavo Suni

The Research Institute of the Finnish Economy, ETLA