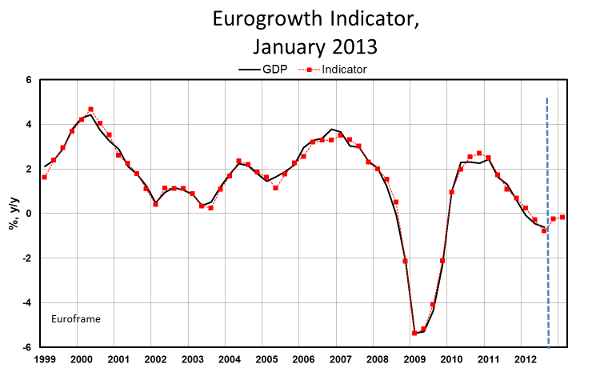

The January results of the Eurogrowth indicator, calculated by Euroframe, provide little reasons for optimism. Real GDP growth is not expected to recover, although last forecasts indicate that the decline in economic activity would come to an end in the turn of 2012 and 2013. Given the uncertainty around the estimates, those results should be taken with caution since they rely on a very recent rebound of manufacturing survey which cannot be taken as a reliable signal for an upturn. Such developments in business surveys already occurred in the turn of 2011 and 2012, but yet they provided a false signal for a positive GDP growth rate in 2012Q1.

The contribution of the industry survey moves up a little bit, but it is still negative so that no positive impulse to GDP growth is expected from this sector in the near term. The construction survey is rather neutral. Stock prices have recovered from their trough in late Spring of last year, driving up the growth rate, while the contribution of the real exchange rate of the euro against the dollar has been slightly positive for five quarters. On the negative side, the households are still quite pessimistic so that the contribution of the confidence indicator further worsens from already very low levels.

It is obviously too early to say that the crisis is over, but some very preliminary evidences suggest that the bulk of the negative developments the Euro area experienced for one year would come to an end. The key role played by the European Central Bank last Summer – the announcement of the Outright Monetary Transactions – has probably been a major contribution to the solution of the problem by getting the financial system rid of the sovereign debt risk. However, the growth path in the euro zone still suffers the drastic budget consolidation implemented by country members. As long as fiscal policies in the Euro area will be constrained by the reduction of deficits and debt ratio, the restrictive effects of fiscal tightening will not raise the near term outlooks.

January 11, 2013

Hervé Péléraux

OFCE