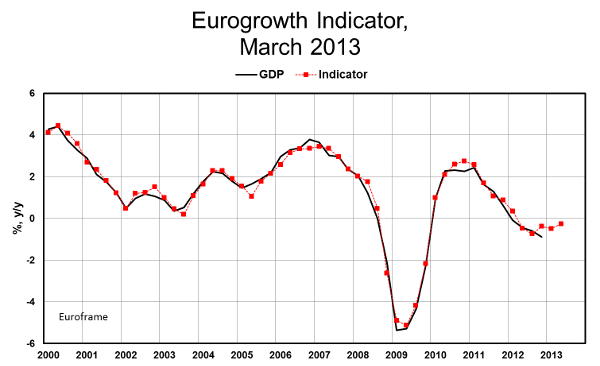

The outlook for the euro area economy has improved somewhat in recent months. After five consecutive quarters of a decline of real GDP, the March estimate of the Eurogrowth indicator predicts a minor positive growth for the first two quarters of this year. So after the steep drop at the end of 2012, there may be an increase in the first quarter of 0.3 percent, followed by a small increase of 0.1 percent in the second quarter. This positive news is quite in line with some other forecasts especially concerning Germany: the largest economy will probably experience a substantial rebound after the strong decline in 2012/Q4.

However, some caution is warranted because the positive outlook so far depends mainly on the improvement of sentiment indicators, while the hard facts concerning new orders, production and sales are still too weak to support the forecast that the turnaround is already here. And it has to be kept in mind that forecast models may not be very precise when it comes to predict the exact timing of a turnaround.

Among the sentiment indicators, the good news comes only from the industry survey which has shown a substantial upturn since the end of last year. The other indicators considered in the model (construction and household surveys) however, have remained rather weak and do not contribute to the expected positive growth. A slight deterioration is to be expected from the exchange rate since the euro has been rather strong against the US-dollar.

The improvement of the survey is probably a reflection of the relief on financial markets concerning the future of the monetary union. A breakup like it was discussed a few months ago is not in the headlines anymore, and bond yields and volatilities have come down quite a bit. But certainly it is too early to say that the worst is over. The outlook for fiscal balances is uncertain, and it is also unclear when growth will return in the countries in a crisis. Nevertheless, according the Eurogrowth indicator, there is some hope that GDP will, at least, show some small improvement for the euro area as a whole.

March 13, 2013

Joachim Scheide

Kiel Institute for the World Economy