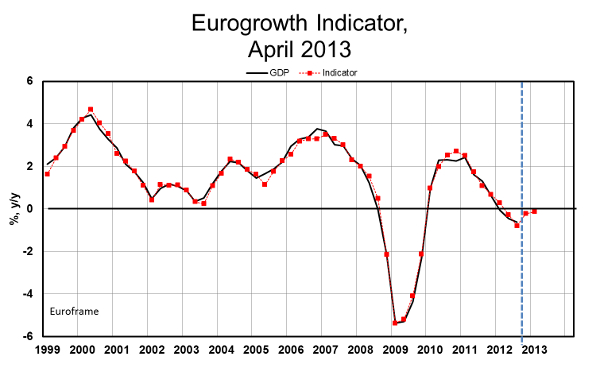

According to the April estimate of the Eurogrowth indicator, conceived by Euroframe, the real GDP growth in the euro area could turn positive in the first quarter of 2013. However, this rebound, which may partially compensate for the steep decline at the end of last year, could be short-lived since the growth rate is expected to fall back to zero in the second quarter of 2013. This positive news for a break in the recession, at least in the first half of 2013, is in line with expectations concerning Germany: the main economy of the euro area will probably experience a substantial rebound after the strong decline in 2012/Q4.

The April indicator forecasts are practically unchanged from the March estimates. Only the second quarter forecast has been slightly downward revised, -0.1 percentage point. The improvement in the near-term outlook comes from the industry survey which has shown a strong upturn since November 2012. As a consequence, its contribution turned from negative to positive in the first quarter of 2013. However, the fall back of the industrial survey in March points out that some caution is warranted given confidence indicators may be somewhat volatile while reflecting sentiments about the financial market situation or developments in the euro area crisis, in addition to current business conditions. The other components of the indicator, construction and household surveys, are still rather weak and do not contribute to the expected positive growth. The lagged effect of the decline in the euro/dollar exchange rate up to mid-2012 still supports growth in the first quarter of this year, but the contribution will turn negative in the next quarter reflecting the appreciation of the euro in the second half of 2012.

All in all, it is too early to say that the euro area has troughed in the last quarter of last year. Experience has shown that indicators may not be very precise in predicting the exact timing of a turnaround. Furthermore, if the fears of the euro zone’s breakup receded thanks to the bail-out of Greece and the ECB’s OMT program, the outlook for fiscal balances is still uncertain although drastic budget consolidations will be renewed in most member countries, which means continuing negative impacts on activity for the euro area as a whole.

April 11, 2013

Hervé Péléraux

French Economic Observatory