Etla Economic Research predicts that economic growth will remain stagnant for the next few years. Etla has lowered its GDP forecast from before and now estimates that Finland’s gross domestic product will grow by a good percent next year. This year, GDP will shrink by 0.3 per cent. Finland already drifted into a technical recession at the end of last year, and economic growth will continue to be cut by inflation, the tightening of monetary policy, and Russia’s war of aggression with its indirect effects. Private consumption and investments will contract this year, but the employment effects will remain moderate.

Summary

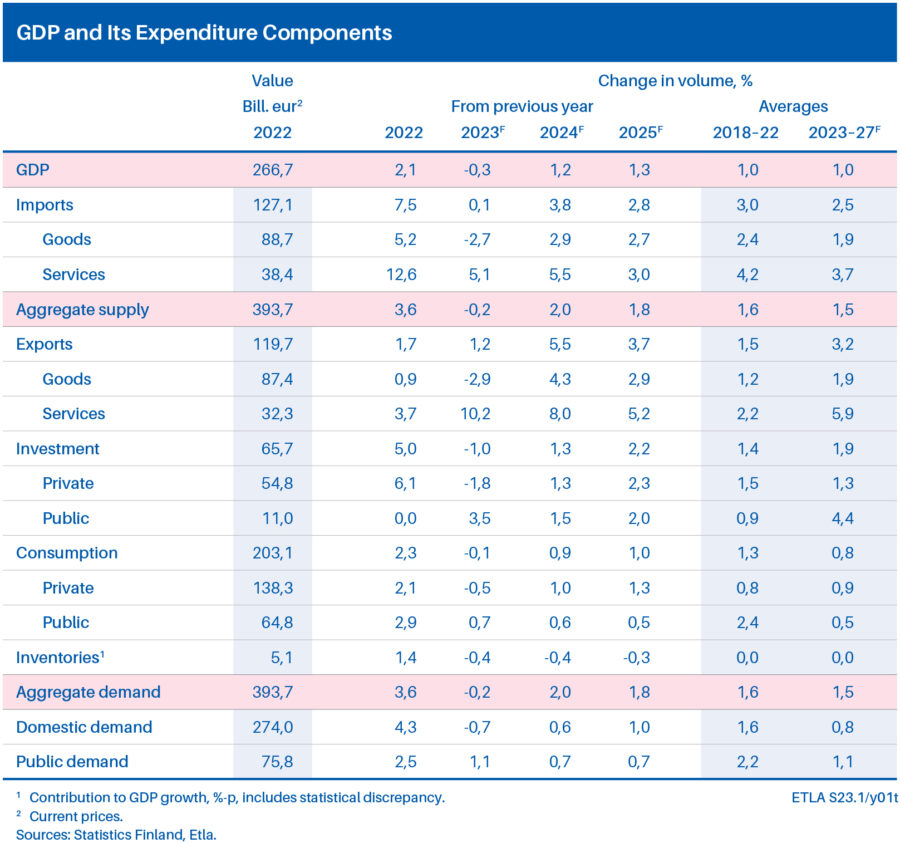

As expected, the Finnish economy weakened already towards the end of last year, when the rise in prices burdened households and private consumption started to decline. Despite the technical recession, the employment situation has still remained good, and there are still many vacancies. Due to the excellent start to the year, Finland’s GDP grew by 2.1 per cent last year. Only net exports were deeply negative; all other demand items increased, and the unemployment rate fell to 6.8 per cent.

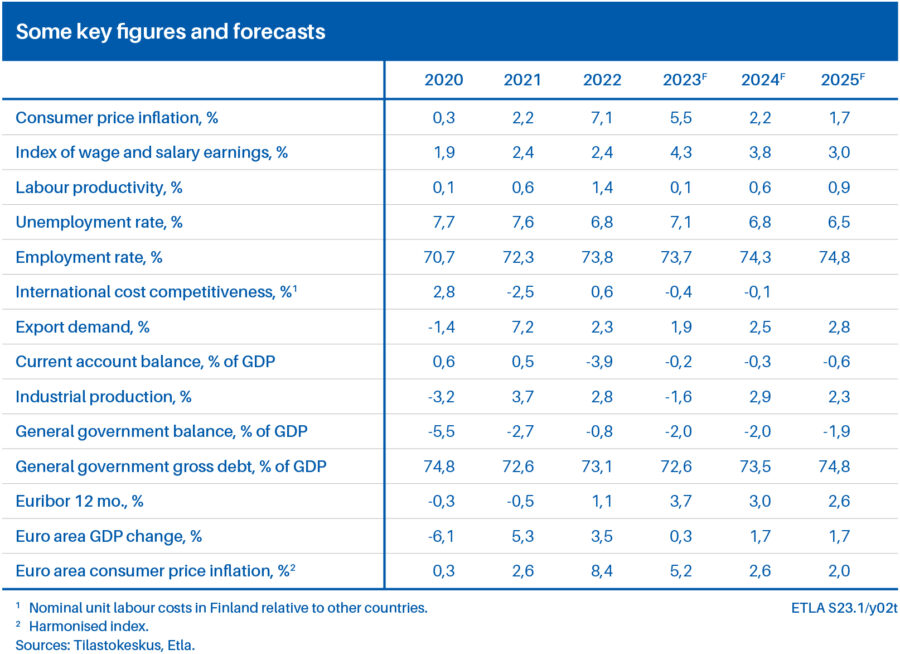

Etla slightly lowered the forecast for Finland’s economic growth. We now predict that Finland’s economic growth will shrink by 0.3 per cent this year and grow by 1.2 per cent next year. The European Central Bank (ECB) has caused surprise with its fast-paced interest rate hikes, which it only started more than a year after inflation began to accelerate. By the beginning of the current year, it has become clear that inflation is more persistent than expected, and the interest rate policy cannot yet be said to be significantly reflected in inflation. Therefore we expect more key interest rate hikes early in the year. We forecast inflation in the eurozone to be 5.2 per cent this year and 2.6 per cent next year. Finland’s national inflation will remain at 5.5 per cent this year and decrease to 2.2 per cent next year.

The rise in interest rates will hit the Nordic countries particularly hard, as owner-occupied housing is more common there than in many other countries, and mortgages have variable interest rates. Despite wage increases, the purchasing power of households will continue to weaken this year, and in the autumn, investments will be postponed more than expected. The rapid rise in interest rates deepens and prolongs the downturn in construction, dragging investments down by 1 per cent. When the savings made during the coronavirus pandemic have been used up and the decrease in purchasing power has impoverished households, private consumption will as a result shrink by 0.5 per cent. By the end of the year, consumption may already be recovering, and will increase by 1 per cent next year. Service exports, which are still recovering from the coronavirus pandemic, are driving exports to a growth of 1.2 per cent, although goods exports are shrinking. Next year, goods exports will start to take off again, and exports will grow by as much as 5.5 per cent. Offloading overgrown inventories will weaken growth.

At the moment, the economy is experiencing crosswinds. The outlook for the global economy has improved since the autumn. The world economy will still grow slowly this year, by 2.5 per cent, and will accelerate to around 3 per cent in the coming years. An important hub for international trade and the world’s second largest economy, China maintained strict social restrictions for a long time due to the coronavirus pandemic. We expect China’s economy to grow again by 4–5 per cent in each forecast year.

The recovery of Chinese production is good news for Germany, Finland’s most important trading partner, and therefore also for Finnish exports – but at the same time, it increases the uncertainty related to the prices and availability of raw materials. Last year, China’s lower demand for energy and a mild winter helped Europe to avoid a severe energy crisis.

The replacement of Russian natural gas, especially in Europe’s large economies, Germany and Italy, and the replenishment of gas stocks caused energy prices to skyrocket, including Finnish electricity prices. The cessation of Russian oil imports was also visible in Finland in the form of increased fuel pump prices. The prices of energy and other raw materials have subsequently started to come down, but inflation will remain high this year, which is increasingly due to demand factors.

The growth of the world economy depends to a significant extent on the developing economies. In developed countries, the picture of the business cycle is very similar. The beginning of last year was excellent, but towards the end of the year, the economic situation worsened when the rise in interest rates and prices hit the economy hard. The war in Ukraine and its consequences affect Europe in particular. The eurozone economy continued to grow throughout last year, but clearly slowed down at the end of the year. The eurozone economy will not grow this year, but will then return to 1.7 per cent growth.

With the exception of Japan and China, the tightening of monetary policy is a global phenomenon. The Fed’s interest rate hikes are already reflected in a slowdown in inflation in the United States, and inflation is expected to fall close to 2 per cent at the end of 2024. The slowdown in inflation in the United States also reduces import inflation elsewhere. In the United States, inflation has been accelerated by rising labour costs due to the tight labour market. Uncertainty in the interest rate market has recently been caused by the takeover of the Silicon Valley Bank by the US authorities. European and US banks are, however, significantly more solvent now than at the time of the financial crisis.

Since the downturn will be mild, we do not expect any special upturn either. Economic growth will rather remain stagnant when the fuel of economic growth has run low.

The end of trade with Russia seems to be affecting the Finnish economy less than was expected. Goods are still being delivered to Russia for which an agreement was made before the war and sanctions. The export of machinery and equipment to Russia has shrunk sharply, but exports to the United States and Brazil have conversely increased. However, the competition on the export market is getting tougher, since other Western countries have also lost their share of exports to Russia, and therefore the loss will not be fully compensated.

Russia’s war has frozen the relationship between Western countries and Russia. International trade is also increasingly affected by the cooling of the relationship between China and the US, and by the rise of protectionism related to security and to the green transition. With the war, Western countries became aware of their dependence on China, which they are now trying to get rid of by supporting companies located in the United States and the EU. As the EU is relaxing its state aid rules in response to US aid measures, concerns about the operation of the EU’s common market and the survival of Finnish companies are rising.

The EU regulation of fiscal policy is moving, with justification, in a more country-specific direction. It is nevertheless unclear how to guarantee equal treatment of the countries when negotiations on the adjustment of public finances are conducted between the Commission and the member states. With the reform of the EU rules, the EU is abandoning the so-called debt criterion, which would require Finland to make an adjustment of the same magnitude as the Ministry of Finance and the Economic Policy Council have proposed.

The debate on mutual debt in the EU has not yet ended either. The mutual debt of EU countries that are more indebted than before may not be a safe harbour for long, unless sufficiently high credit ratings can be maintained. At the end of 2022, already 35 per cent of the eurozone’s public debt was held by the Eurosystem. When the ECB reduces its holdings, the countries’ fundraising is increasingly dependent on the market.

In February, the credit rating agency Fitch confirmed Finland’s credit rating as AA+ on the condition that the public finances are successfully adjusted. In our forecast, Finland’s public debt ratio will rise to almost 75 per cent from which the trend is upwards. It seems that market discipline is beginning to matter again.