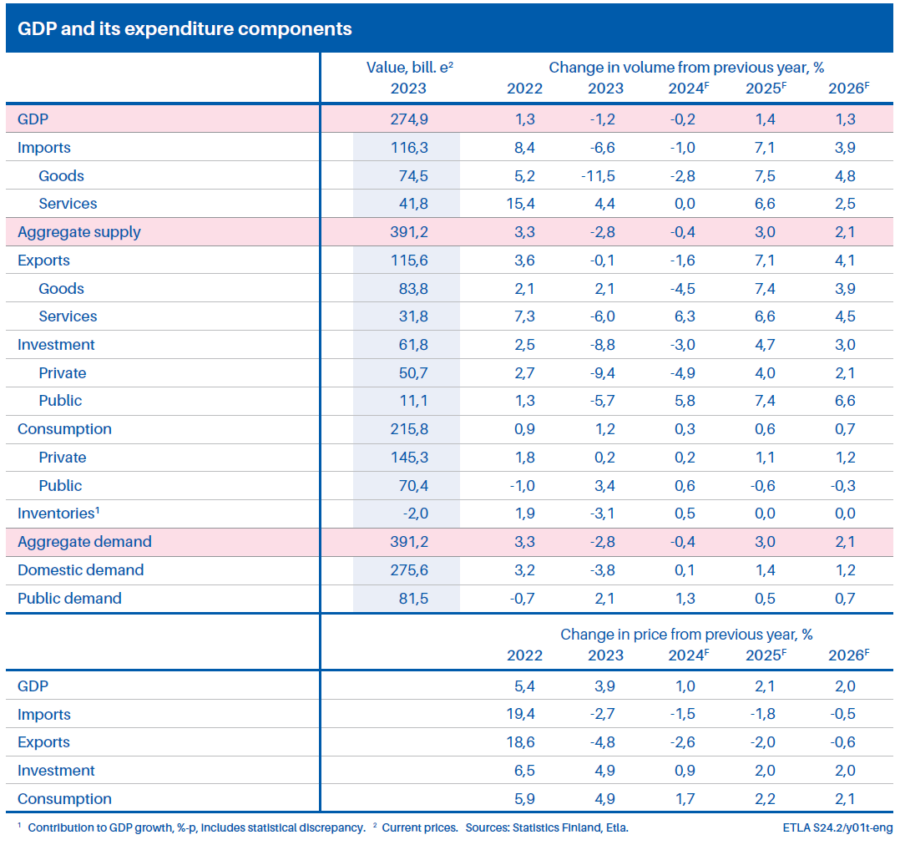

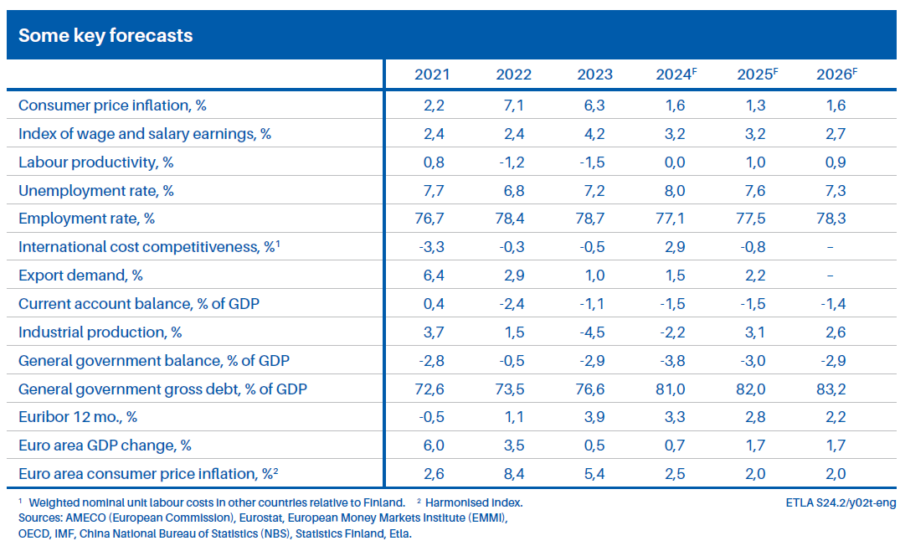

The Finnish economy is set to remain the worst performer in the euro area this year, predicts Etla Economic Research. Finland’s GDP will contract by 0.2 per cent this year, virtually matching last year’s level. Next year GDP will grow by 1.4 per cent. International demand will not be enough to drive export growth this year. Investment will continue to contract. Unemployment will rise this year but fall next year. For the first time in a long time, the working age population in Finland is growing.

Summary:

The Finnish economy is set to be the worst performer in the euro area this year, says Päivi Puonti, Head of Forecasting at Etla Economic Research. GDP will contract by 0.2% this year and grow by 1.4% next year. Investment will still contract this year. There is some uncertainty about investment in construction, but Etla expects investment to increase significantly next year.

Private consumption growth will remain modest this year, as household purchasing power improves less than expected. Growth in private and public consumption will be partly restrained by fiscal adjustment measures. In particular, the government’s adjustment programme will curb the growth of consumption and social security expenditure by EUR 3-4 billion by 2027.

The employment rate will fall temporarily this year, and unemployment will rise to 8%. Next year, the unemployment rate will fall again.

– In a cyclical upturn, employment always follows with a slight lag. It is good to note that despite the cyclical conditions, the employment rate in Finland has been on the rise since 2015. However, our problem is still structural unemployment, and the economic cycle will not fix it, says Päivi Puonti, Head of Forecasting.

Etla’s forecasting team has also calculated the impact of the recent increase in immigration on employment. Net immigration was exceptionally strong last year and has continued to be strong this year.

– The working age population is growing for the first time in a long time. There are newcomers from many different countries, so it is not just a matter of people fleeing the war in Ukraine and coming to Finland,” says Sakari Lähdemäki, researcher in Etla’s forecasting team.

Etla will publish a more extensive special article on immigration later in the autumn.

The recovery in tourism and other services in southern Europe is not helping Finland’s economy either. On the contrary, it has accelerated the rise in service sector prices, mainly wages, and thus delayed interest rate cuts by the European Central Bank.

It is a pity that Germany, one of our main trading partners, is in a similar situation to ours, says Päivi Puonti, Head of Forecasting.

– Germany’s economic performance this year will be at the tail end of the G7. As monetary policy eases and the business cycle normalises, deeper structural problems will remain. In Germany some of the same questions as in our own country are being asked: how to attract skilled workers to an ageing workforce and how to improve the long-term structure of the economy.

Diversification of the export structure would help and protect the economy from cyclical fluctuations. In the next few years, both exports and imports will grow at roughly the same rate, so net exports will not be a catalyst for Finland’s economic growth.

There are therefore high expectations for the growth package to be discussed at the so-called spending limits session next spring, says Aki Kangasharju, CEO of Etla Economic Research.

– The government needs to invest more strongly in the conditions for productivity growth. A temporary investment incentive and recapitalisation of The Finnish Industry Investment Tesi (a state-owned, market-driven investment company ) are not enough. Realising the competitive advantage of wind power and improving the productivity of social services require a broader productivity programme.

Despite spending cuts, the ratio of public spending to GDP remains high, as elsewhere spending is rising. This is why international credit rating agency Fitch downgraded the outlook for Finland’s sovereign credit rating to negative in August.

The change means that the rating agency believes that the risks associated with the government’s debt development are on the rise, says Päivi Puonti, Head of Forecasting.

– As general interest rates have risen, investors have started to demand higher yields from Finland compared to Germany or Sweden. The difference is not huge, but it is clear. Finland’s long market interest rates are now following France, whose long-standing indebtedness is already being tackled by the EU’s excessive deficit procedure (EDP), Puonti says.

The online version of Etla’s Economic Forecast “Suhdanne” (in Finnish) is available for reading and downloading at www.etla.fi. All graphs and tables in the online version can also be downloaded separately at www.suhdanne.fi. A PDF version (in Finnish) can be downloaded at etla.fi/publications.

More information:

Head of Forecasting Päivi Puonti, ETLA, tel. +358 44 465 0177, paivi.puonti@etla.fi

Researcher Birgitta Berg-Andersson, (foreign trade), ETLA, tel. +358 44 465 0153, birgitta.berg-andersson@etla.fi

Researcher Ville Kaitila (private consumption, prices and costs), ETLA, tel. +358 50 410 1012, ville.kaitila@etla.fi

Researcher Sakari Lähdemäki (international economy, employment, investment), ETLA, tel. +358 40 746 2991, sakari.lahdemaki@etla.fi

CEO Aki Kangasharju, ETLA, tel. +358 50 583 8573, aki.kangasharju@etla.fi