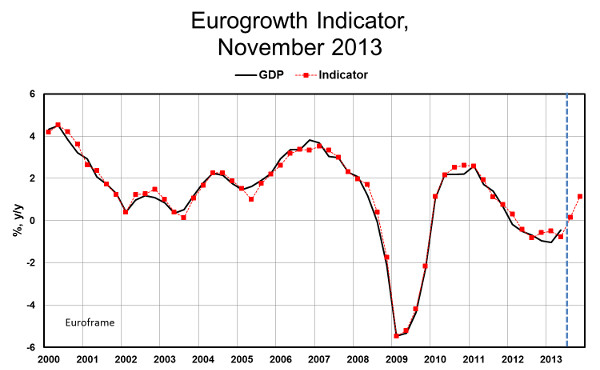

The Eurogrowth Indicator, calculated by the Euroframe group in the beginning of November, points to a rather strong 0.5 per cent growth for the Euro Area in the third and fourth quarters of 2013. The estimates have been stable since September, when the fourth quarter estimate was published for the first time.

The rather strong projected growth in the second half of 2013 is mainly based on the strong industrial confidence factor in both quarters, although its impact declines a bit in the fourth quarter. On the other hand the impact of household survey data has dragged the growth rather strongly downwards for the whole year, but its trend is improving and household confidence compensates for the declining support of the industrial confidence in the fourth quarter. Construction confidence is rather stagnant and contributes only slightly negatively to the Indicator in both quarters. The contribution of real euro/dollar exchange rate continues to be neutral.

The estimates give more reason to believe that after six consecutive quarterly declines the weak turn-a-round in growth in the second quarter of 2013 is real although the indicator would time the turn in the first quarter.

The upward trend shown by the indicator is, however, clear and the timing difference may be due e.g. to catching up of Euro Area construction in the second quarter after cold winter. Seasonally adjusted Euro Area construction grew by 1.8 per cent in the second quarter after strong 1.4 and 3.7 per cent quarterly declines in the two winter quarters. This would imply accordingly a drag on the third quarter GDP growth estimate by the Eurostat in contrast to the current rather strong Indicator estimate.

There are risks for the fourth quarter GDP estimate in particular. While an improvement of the industrial confidence declined in October from September, the measures of confidence for services, retail sales and construction declined in absolute terms. High unemployment in the Euro Area combined with the severe governance problems in the US, notably the scary debt ceiling debate, and some signs of moderation in emerging market growth at that time may have served as a drag on the confidence and may risk the confidence in the fourth quarter.

In addition, the recent strengthening of euro vis-á-vis the US dollar is not yet affecting the Indicator through real exchange, as the euro/dollar exchange rate affects the estimates with a lag of two quarters. It may, however, affect industrial managers’ expectations negatively in the fourth quarter of 2013 and weaken the next fourth quarter GDP estimate accordingly.

All in all, the Eurogrowth Indicator would imply a stabilization of output for the year 2013 on average, while consensus estimates point to a 0.3% decline. Part of the difference may be explained by different quarterly developments due to temporary seasonal effects including the carry-over from the year 2012. However, the message of the Indicator for the Euro Area growth this year is stronger than consensus.