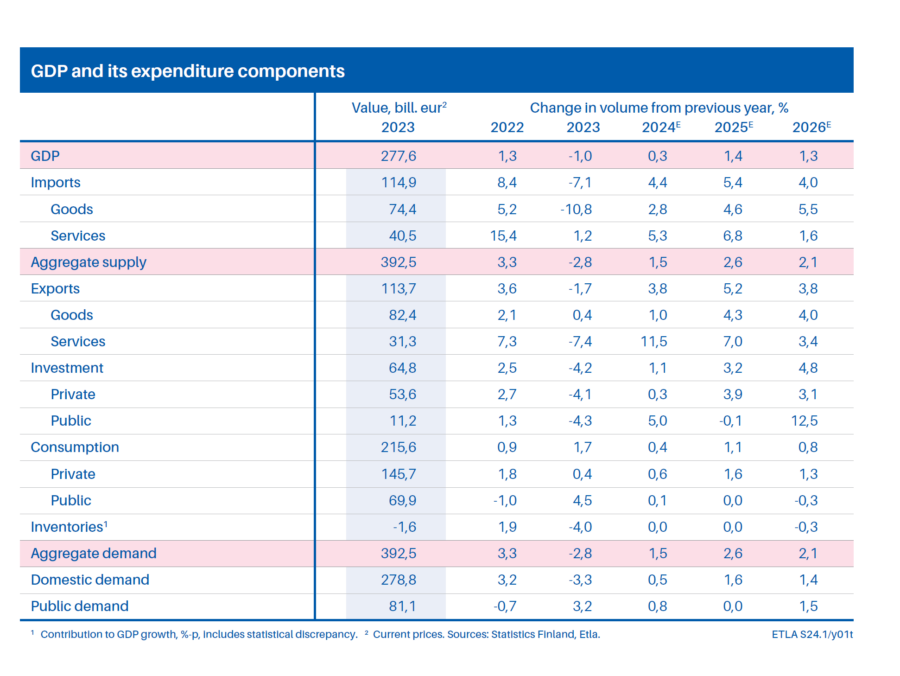

The Finnish economy is expected to grow by 0.3 per cent this year, predicts ETLA Economic Research. Although GDP will contract in the early part of the year, it is expected to rebound by the end of the year. Next year, Finland’s GDP growth is forecasted to reach 1.4 per cent.

Summary:

Inflation was expected to decrease gradually, and as it finally came down, the expectation shifted to it slowing down to the European Central Bank’s target of 2 per cent. Currently, the target is almost reached in Finland and is remarkably close in the euro area.

It is anticipated that the central bank will reduce its policy rate. The interest rate cut and the prospect of lower interest rates are the last signals that inflation has been tamed. We believe that the turnaround in the business cycle will happen this year, although a weak start to the year will push full-year growth down to 0.3 per cent.

According to the World Bank, the current decade has been a lost decade for the global economy. However, there are different underlying trends. China’s economic growth is decelerating and is not meeting the government’s targets, while the United States is surpassing Europe, despite the Federal Reserve tightening monetary policy at a faster rate than the European Central Bank in the Eurozone.

Additionally, Europe is currently experiencing an energy crisis due to Russia’s aggressive actions, which is not the case for the energy-rich United States.

Furthermore, there are significant variations in the developments within the Eurozone. In Finland, construction investment has been contracting for the second consecutive year, while the investment boom in southern Europe is only slowing down. This difference can be attributed to the structure of the economies.

Tourism has helped keep the service-intensive economies of southern Europe growing. In contrast, industry and construction, which play a significant role in Finland and Germany, have been the main drivers of their economic downturn. German industry is facing structural problems, particularly due to the restructuring of the automotive industry and the absence of affordable Russian gas. In contrast, French industry has benefited from nuclear power during the energy crisis.

Additionally, the transfers from the EU recovery instrument appear to have been well-timed for the economic cycle, although they did not go to the countries experiencing the most severe economic downturn.

The European Central Bank is currently awaiting statistics on euro area wages and a slowdown in services inflation before deciding on the first cut in the policy rate, which we expect to occur in June. The euro area economy has remained in positive territory due to strong demand for services. However, service prices, mainly wages, have risen faster than other inflation items.

Finnish exports are expected to recover this year, but they are projected to take off next year as economic growth in key export markets, Germany and Sweden, strengthens. Although exports in many sectors have already bottomed out, the strikes that began in March are causing uncertainty. Once again, the strikes will have the greatest impact on the forest industry.

The services balance is expected to remain negative during the forecast period, despite the anticipated recovery of exports from the ICT sector. The tourism balance is expected to remain persistently weak. Although a cyclical turnaround is expected this year, real economic growth is not expected until next year, when Finland’s GDP growth is projected to reach 1.4 per cent.

Investment and household consumption will be the main drivers of growth. Despite the purchasing power crisis in 2022, private consumption in Finland has continued to increase slightly. We predict that private consumption will experience modest growth this year as well. This year, households’ purchasing power is expected to improve, and the savings rate will return to positive territory.

The government will continue to adjust public finances. Tax cuts may also be implemented, which could reduce the growth of the savings rate and consumption. Investment is expected to experience broad-based but modest growth this year. Private investment is not expected to significantly increase until next year, but this year its weakness will be offset by public investment in infrastructure and R&D. Residential investment is expected to continue contracting this year, but we anticipate a turnaround by the end of the year.

Although the economic cycle is currently weak, it is expected to improve without the need for specific policy measures. However, some issues will not improve by waiting, such as Finland’s long-term economic growth prospects and fiscal position.

Over the forecast period, the government’s adjustment programme will amount to just over EUR 3 billion. Additionally, several expenditures will increase, including the multi-annual local government pay programme, the R&D financing law, social welfare spending, interest payments, index-linked pensions, and infrastructure investments. The government plans to finance the infrastructure investments by selling state assets for around €3 billion.

Although the investment programme will not increase public debt, it will increase the deficit by almost the same amount as the adjustment programme.

Additionally, the reduction in unemployment insurance contributions and the resulting reduction in social security fund surpluses also increases the government deficit. However, this action does not increase the debt, but it is reflected in a higher deficit.

The European Union’s new fiscal rules will exert pressure on the government to explicitly reduce the deficit. If debt reduction is also a goal, the focus must be on the most indebted sectors: central government, municipalities, and wellbeing services counties. To ensure economic growth is not damaged, public finances must be adjusted in a way that minimises harm on long run economic growth.

It is important to note that public finances and economic growth are closely linked.

Somewhat surprisingly, Italy’s economy grew at the end of last year, while Germany’s and Finland’s contracted. Additionally, Italy is projected to continue growing at a faster rate than Germany. The interest rate differential between Italy and Germany has fallen to its lowest level in two years, reflecting Italian Prime Minister Giorgia Meloni’s efforts to reduce the budget deficit, improve the Italian economy, and the challenges facing the German economy.

The market is rewarding Italy’s efforts to promote economic growth while reducing the public deficit, which is also the goal for Finland.

Etla’s forecasting team, from left: research assistant Jaakko Rahko, researcher Sakari Lähdemäki, Head of forecasting Päivi Puonti, researchers Ville Kaitila and Birgitta Berg-Andersson.