At the end of May, portfolio managers of European pension funds convened in London to discuss investment strategies in a world of uncertain growth and negative or near-zero interest rates. There once was a time where long-term investments were considered a conservative strategy, while placements in stocks, private equity, and hedge funds were considered financially adventurous.

No longer

Even though pension funds have long-term liabilities, regulatory pressures and volatility worries requires managers to shift strategies to short term results. In Europe, the volatility and risk concerns would appear to drive reallocation to fixed income instruments (low risk and volatility) or private equity (low volatility). However, given the poor performance of many funds (arguably below or near tipping point of growth to meet liabilities), funds are experimenting with new types of alternative assets. That is, of course, provided risk and volatility are manageable.

The roundtable indicated that particularly German, Danish and Italian representatives argue that performance growth will come from increasing allocations in the real economy.

Indeed, worries about stagnating growth and high unemployment in the EU region have driven monetary and investment policies to stimulate the part of the economy that is concerned with producing goods and services. The European Commission’s Finance and Banking Committee recently approved regulation on long term investment funds (LTIFs), consisting of 70% illiquid assets and minimum holding periods of 5-7 years. The EU Strategic Investment Fund, proposed by Commission President Juncker aims to achieve a 15x leverage of private: public investments, with focus on growing the real economy.

Will pension funds bite?

That depends on the investment committee charges and restrictions, most of which are regulated at the member country-level. Aside from projects and infrastructure, monetary policies have advocated innovations in debt capital to grow small and medium enterprises (SMEs). For example, investments in illiquid credit and aggregated loan instruments with government floor guarantees are on the rise in Europe.

Financial innovations such as intra-EU SME risk ratings and localized SME debt swap markets (e.g. between Stockholm and Helsinki) have sprung up to address capital access needs for growth. New ‘minority equity’-type credit instruments for SME growth are in inception phase, indicating that the real economy alternative investment asset class is becoming more diversified.

Nibbling at the heels of private equity, hedge funds and real estate.

Admittedly, PE is currently the primary alternative asset class to hedge funds and equities. The low volatility and negative correlation between PE and equities offer attractive risk benefits to investors, resulting in an average of 4-5% of total allocation. Other alternatives make up the difference.

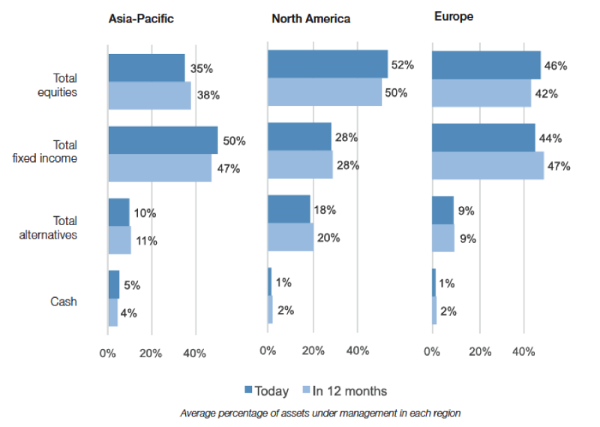

According to a 2014 AMP Capital Research Report on Asset Allocation shifts, EU pension funds on average allocate 9% in alternatives vs 20% in the US. So they still have a way to go to close the gap. The same report also illustrates the fixed income disparity between Asia Pacific and Europe on the one hand, and North America on the other. Investment committee restrictions are partly to blame.

Multi-Asset Funds to the Rescue?

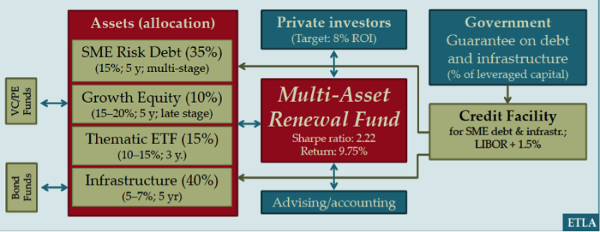

In recent years, multi-asset funds have been designed to meet investor objectives by integrating all asset classes represented in the figure. The mix of desires for returns, low volatility and low risk can be met by structuring closed end funds with longer term lock ins. A key challenge is the management of such funds, given the different strategies employed to optimize each asset class and the overall portfolio.

To date, there are 32 multi asset ETFs in the US alone, attractive to investors seeking instant diversification. Despite the (current) fringe allocation of pension funds to multi-asset ETFs, their structure and performance has shown the opportunity for scaling investment in riskier asset classes with proper diversification across thematic portfolios.

A Multi-Asset Fund Primer: Scaling Investments in the Real Economy

Multi-asset funds and ETFs have opened the door to financial innovation for scaled investment in the real economy. Exposure to SME debt and growth equity to drive GDP growth and employment can be coupled to financial returns at risk profiles attractive to long term investors.

Our work at the Research Institute for the Finnish Economy (ETLA), in cooperation with economic developers, pension funds and wealth management investors is innovating new multi asset fund structures (multi-asset renewal funds, MARF) that have the capacity to drive new economies.

The ‘Finnish MARF Model’ efficiently and rationally identifies and allocates companies and projects driven by real economy data flows.

Three MARFs will be designed and rated under the ETLA umbrella: Smart Grid, Smart Mobility, and Bioeconomy. Currently, there are two commercial MARF projects under development in cooperation with economic development partners and investors: (1) Green chemistries (Antwerp-Ruhr-Rhein Chemical megacluster; Flanders CleanTech Association), and (2) Smart mobility (Global CleanTech Cluster Association, Switzerland).

Given fund specifications, a $250M. MARF ($25–50M. public funds) has the potential to generate 7,500 new jobs and stimulate $1.5 bn. in economic activity, while generating 6–8% IRR net to investors. Doubling the investment to $500M. has an amplified effect, considering the financial leverage ratio from additional lending against the MARF’s cash position.

Disclaimer: Economic impacts and returns depend on asset class allocation assumptions for the MARF and availability of investable assets.

Peter Adriaens is Professor of Environmental Finance and Engineering at The University of Michigan, Finnish Distinguished Professor, and CEO of the KeyStone Compact Group Ltd, which commercializes the MARF designs and risk analytics.