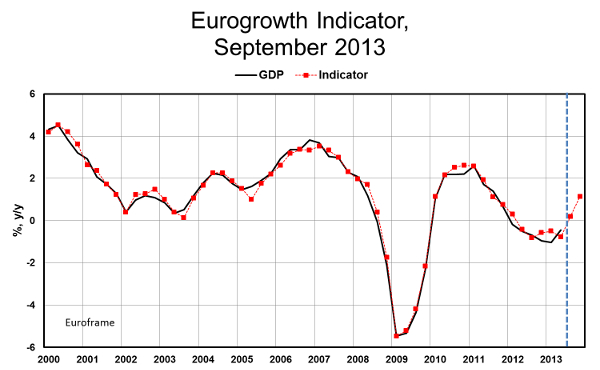

The outlook for the euro area economy has improved considerably in recent months. Not only did real GDP increase in the second quarter for the first time in two years, it will even accelerate during the second half of 2013. According to the September estimate of the Eurogrowth indicator, we should expect increases of 0.55 and 0.45 percent in the third and fourth quarter, respectively. So it seems that a recovery in the euro area is finally on its way. While there were some special factors at work driving up the growth rate for the second quarter, e.g. the catching up of construction spending in Germany after the cold winter, the recovery may become broader based and will include more and more also some of the crisis countries.

The improvement comes mainly from the sentiment indicators which have shown increasing strength in recent months. Especially firms in manufacturing have become more optimistic about the future. The positive swing of the household survey – here the confidence has now a smaller negative contribution to the growth estimate – was also substantial. It may be that the situation on the labor market will stabilize in the near future, even though unemployment will remain probably at a very high level for some time. Other factors such as the real exchange rate and the results of the construction survey only showed minor changes.

The results of the Eurogrowth indicator are somewhat more optimistic than the consensus forecast for this year. According to the indicator, real GDP may stagnate for the year as a whole, whereas many other forecasts still imply a small decline. However, some caution is warranted given the uncertainty of model estimates especially in period of a cyclical turnaround. In addition, the experience in recent years shows that a setback may occur should the crisis in the euro area escalate again. Nobody can know if and when this will happen or what the trigger may be. Since the crisis is far from over, we should not expect that the recovery is already on safe grounds. On top of that, the outlook for several emerging economies has become more uncertain recently, so there may even be a negative shock from abroad.

September 11, 2013

Joachim Scheide

Kiel Institute for the World Economy