In finance, as they say, it is all about the story.

A compelling vision gets traction, but ultimately the financial-technical details need to get worked out. As is the case for innovations such as ESG-based investing, crowdfunding, and yes CleanTech, it may take a decade for investors to define the ROI, and figure out how to make the story work.

Such was also the case in the announcement last week by the Obama administration on private sector commitment to clean energy innovation. Comprised of fairly traditional financing approaches such as equity, projects, and non-dilutive financing, the ROI on the $4bn. investment remains to be seen. Similar issues were raised in a GreenBiz blog by Lauren Hepler on June 16th.

A Need for Efficient Capital Allocation

As designed right now, the White House clean energy deal makes capital available for a wide range of one-off investments. Certainly an announcement to be lauded, but it begs the question whether there aren’t more efficient ways to allocate capital to drive green energy innovation.

“Essentially, there is no long-term investment thesis for these funds – mainly an aspiration for long term impact.

A two-year collaboration between Peter Adriaens, Professor of Environmental Finance and Entrepreneurship (Ross School of Business – University of Michigan) and the Research Institute for the Finnish Economy (ETLA) aims to address inefficiencies in capital commitments for greening economies.

The objective of the financial innovation project is to engage long-term investors such as pension funds, insurers, and wealth management in green economic development and job creation. The initial approach was traditional, focusing on screening Finland’s 1,600 self-identified CleanTech companies against investment criteria relevant to lenders, project and equity investors.

It became rapidly apparent that this approach would not result in the financial and other ROI metrics of the target audience: long term investors and economic developers. It was not, as vice-President Biden would refer to: “smart economic play”. One-off (one-at-a-time) investments distributed across multiple asset classes are very inefficient, have vaguely-defined outcomes, and are a poor investment size fit for long-term investors.

Large investment banks have known this for a long time. Multi-asset funds comprised of different asset classes of variable liquidity have grown in recent years to address both long-term strategies and risk profiles of institutional investors. Moreover, lenders have innovated as well, by using loan originator and aggregation platforms that find attractive deals for ROI growth of their portfolios.

Multi-Asset Renewal Funds (MARF)

The financial innovation of the Finnish project is essentially a reinvention of value system investing. As Antti Savilaakso, MSCI Head of ESG Research (formerly at Nordea) and a project steering committee member, noted: “The pension fund investment model is broken; we need financial innovation to retain the value capture from investments locally. Too often is the value generated on investment capital captured abroad. ”

The MARF concept connects the learnings from large asset managers with economic growth (translation: SMEs; small & medium enterprises) and financial ROI objectives.

“To enable this, a replumbing of financial pipelines is required that allows large capital investment commitments in local or regional economies to grow at market returns.

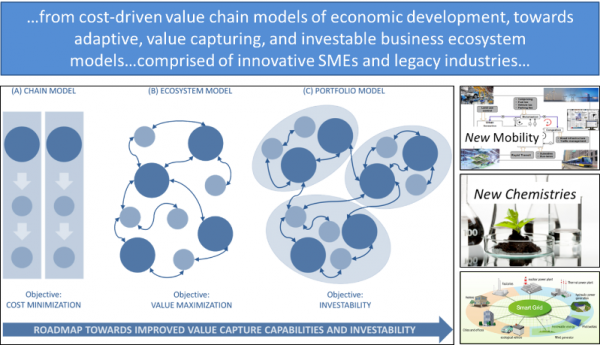

The fund design reflects cross-sectoral industry ecosystems that enable new economies. Examples of these are: smart mobility and smart grid, bio-based chemistries and biomimicry. These industry value chains leverage existing assets and industry players that are repositioning for new growth opportunities.

Using financial and qualitative input data from Bloomberg, the CleanTech group, and CB Insights, supplemented with financial performance data for SMEs (in our case: participants in the Finnish economy), a thematic fund scaffold is constructed using network mapping tools.

The public and private companies comprising this structure are screened using financial and non-financial (KeyStone Compact) risk metrics and allocated in four asset classes. These include Risk Debt (for SMEs), syndicated equity, an ETF, and Projects. The asset allocation is designed commensurate with the risk and return profiles of long term investors, including a government guarantee on debt.

It is important to note that the design process was informed by engagements with Finnish pension funds such as Elo, Ilmarinen, and VER. The viability of the fund’s investment and governance structure were iterated with input from KBC Bank, Deutsche Bank UK, and Sitra. Initial ideation of the fund structure was conducted using the LEGO Serious Play program.

In summary, MARFs are smart instruments to scale investments in SMEs, while advancing innovation in green energy, smart infrastructure, and other sectors ripe for disruption. Based on simulations, they are poised to deliver returns at market rates.

In partnership with the Global CleanTech Cluster Association (GCCA) and its 50+ member clusters comprising nearly 10,000 companies, we have a deal pipeline for multiple MARF designs. Three MARFs will be structured as part of the project and rated by Fitch in 2016, in time for our engagement with anchor investors.

Peter Adriaens is CEO of the KeyStone Compact Group Ltd, Professor at The University of Michigan, and Finnish Distinguished Professor. He can be reached at pa@keystonecompact.com.